Active funds are an essential component of the investment universe, but their costs and performance vary significantly between Europe and the United States. While European investors often face higher fees, they are nonetheless attracted by the idea of potential outperformance. In the United States, however, investors encounter a different dynamic, characterized by both regulatory differences and varying market conditions. This article highlights the key factors influencing the costs and performance of active funds in these two important markets.

Cost Structures: The Delicate Balance between European Scrutiny and American Efficiency

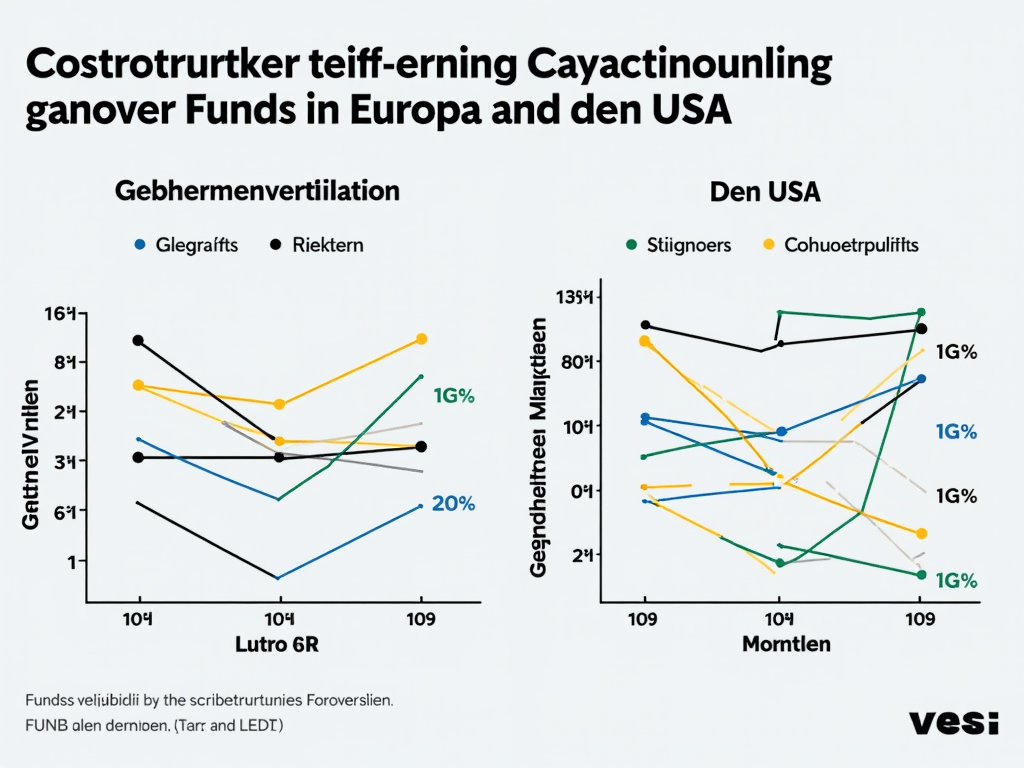

Europe and the United States present as opposites regarding the cost structures of active funds, influenced by different economic, cultural, and regulatory realities. European elegance, a term often associated with a certain formal rigidity, reflects Europe’s tendency to set high standards in regulation and social responsibility. This approach leads to higher operational costs, which translate into energy and personnel expenses.

European companies face stringent environmental and social regulations, which often result in higher energy costs: a comparison of fuel costs shows that German companies pay 65.45 cents per liter of gasoline and 47.04 cents per liter of diesel. These burdens make it difficult to maintain the flexibility necessary to quickly adapt to market changes. However, the advantage of these rigorous approaches lies in the promotion of sustainable investment projects, which promise long-term positive effects on the environment and society.

On the other hand, American efficiency, which is based on less stringent regulations, offers more flexible conditions for businesses. American companies benefit from lower energy costs and an optimized bureaucratic system. Lower average personnel costs stem from more liberal labor legislation, which simplifies both hiring and firing workers.

In finance, European funds tend to utilize state programs and EU funds to support their investment activities. However, this support heavily depends on the overall economic situation, while in the United States, the capital markets serve as the primary source of funding for businesses. This strategy allows for quicker resource allocation and can lead to timely investments.

The direct comparison clarifies how important contextual approaches are: Europe invests heavily in long-term and sustainable projects, while the United States focuses on rapid implementations and low-cost solutions. Both models have their strengths and face challenges arising from the economic and cultural configurations of their respective regions. This delicate balance between stability and flexibility becomes a decisive factor for the success of active funds, which must satisfy both investors and withstand a dynamic financial environment.

Expectations vs. Reality: The Performance Paradox of Active Funds

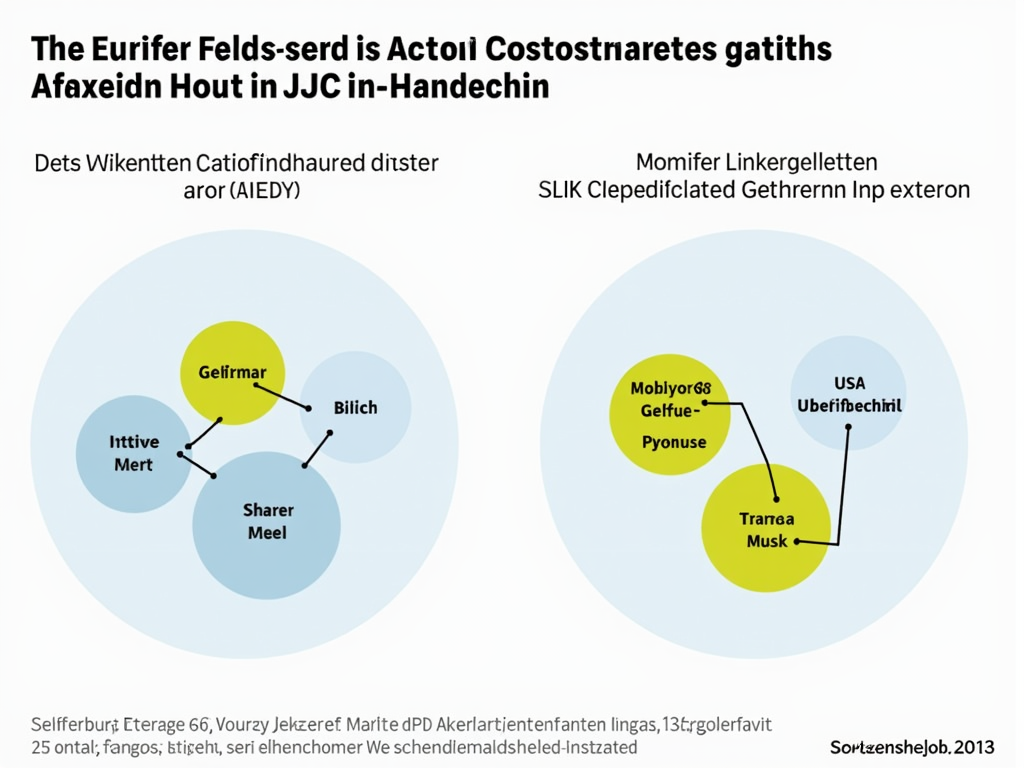

In the current financial landscape, investors often face a conflict between their return expectations and the actual performance of their investments. This performance paradox is particularly significant in the comparison of active funds in Europe and the United States. Investors hope for above-average returns; however, markets often present a more disappointing picture, taking various factors into account.

Active funds are under pressure to justify their higher costs through superior performance. However, this expectation is often influenced by the harsh realities of financial markets. Factors such as market volatility and uncertainties stemming from political or economic developments can dilute expected returns. For instance, decisions made by the European Central Bank, such as interest rate cuts, significantly impact capital markets and make reliable return predictions difficult.

Moreover, the growth trend in the technology sector plays an ambivalent role. Although tech giants, such as AI companies, are often seen as growth engines, even strong quarterly results may not be sufficient to satisfy high investor expectations, leading to price declines. This dynamic underscores the importance of a well-diversified portfolio and sound risk management. Such strategies should enable investors to absorb fluctuations and ensure long-term stability.

An additional layer of complexity is introduced by investor psychology. Psychological traps, such as the commitment trap, can lead investors to irrationally hold onto unprofitable positions. Furthermore, modern investment opportunities via platforms such as Neobrokers, which, despite lower costs, do not necessarily guarantee high returns. The availability and accessibility of such tools increase market participation but also open new dimensions of risk.

Ultimately, navigating the performance paradox requires calmness and a long-term investment strategy. Investors who base their decisions on solid business fundamentals, as in the case of established companies like Novo Nordisk, can transform the potential for high risks into long-term opportunities. By aligning their expectations with the actual context of the markets, investors can ensure they are not only aiming for high returns but also achieving realistic successes.