Pension planning is more than just a financial safety net; it’s the key to a serene retirement. Since state pensions are often insufficient, the three-pillar model and private pension strategies provide a solid foundation. In this article, you will discover how to combine state, corporate, and private pensions and what government grants are available. Each chapter highlights essential aspects to help you make informed decisions and ensure a stable standard of living in old age.

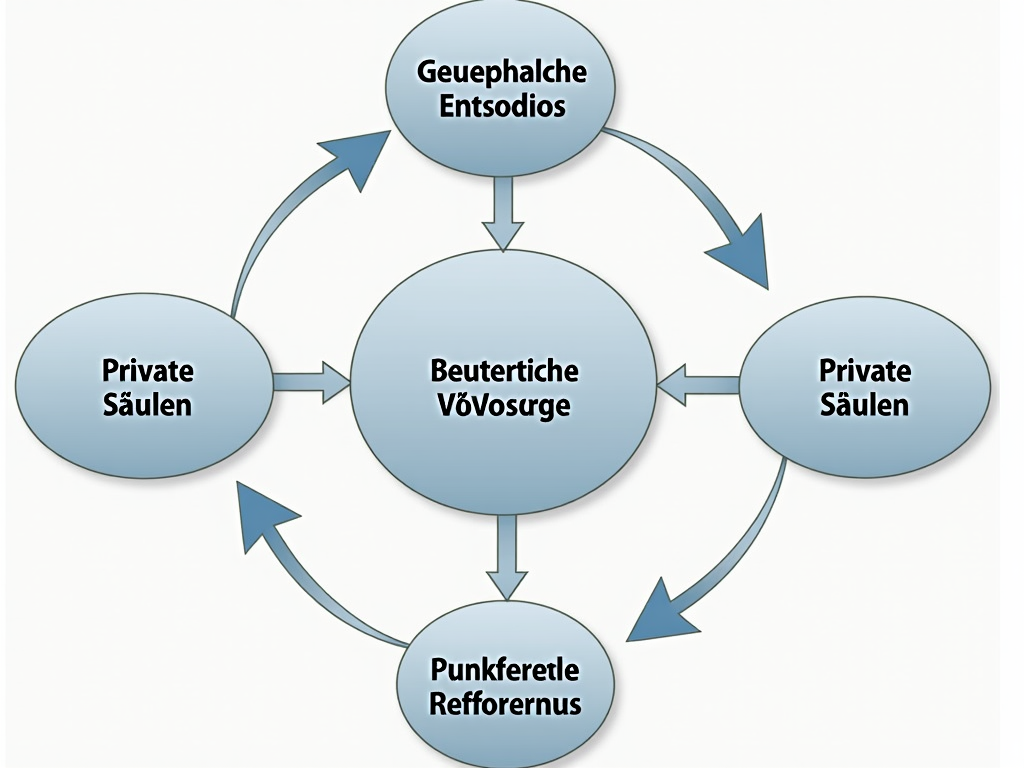

The three-pillar model: Foundation of future pension security

The three-pillar model and its role in pension provision

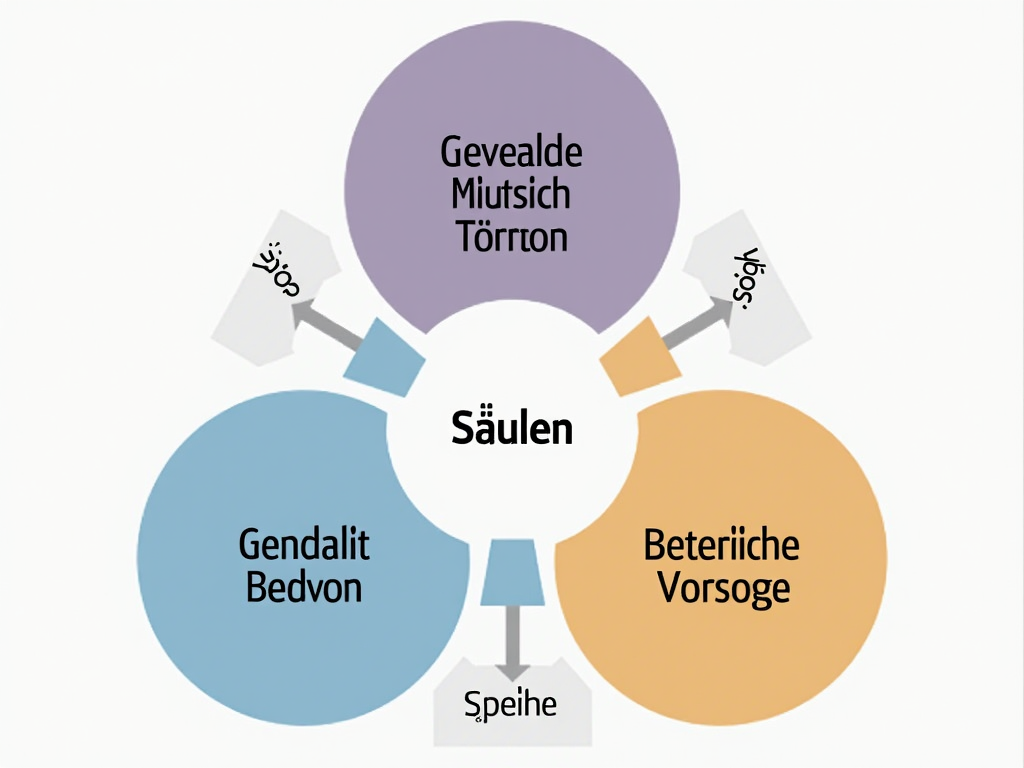

A well-protected pension is based on a thorough understanding of the three-pillar model of pension planning. In Germany, this model constitutes the backbone to ensure financial security in old age. Each of the three pillars offers different benefits and challenges, which can be consciously combined to maintain the standard of living after working life.

First pillar: State pension provision

The state pension provision serves as the fundamental pillar of retirement planning. It ensures that individuals receive a certain level of financial support after a lifetime of work. Despite regular adjustments of pension benefits, the state pension often remains below the income level necessary to maintain the usual standard of living. This clarifies why supplementary pensions through the other two pillars are essential.

Second pillar: Corporate pension provision

Corporate pension provision offers an additional way to increase retirement income. It often takes the form of direct promises or contribution promises from the employer and can be encouraged through tax benefits. This form of pension provision represents an attractive complement to the state pension, especially when the employer contributes to the payments or offers favorable conditions. Long-term planning of such models can significantly reduce the pension gap.

Third pillar: Private pension provision

The third pillar includes all forms of private pension provision, which can be individually tailored. Among the most common options are the Riester pension and the Rürup pension, real estate investments, and investments in securities such as ETF savings plans. Private pension provision offers the flexibility to respond individually to life circumstances and financial possibilities. Timely and ongoing investments can create a solid financial cushion for retirement. Additionally, state grants and tax benefits allow for an attractive optimization of returns.

Conclusion

Understanding and integrating the three-pillar model into individual pension planning is essential for achieving comprehensive and flexible retirement coverage. Each pillar contributes to covering different aspects of pension provision. Through a balanced combination, the respective advantages can be maximized to ensure financial independence in old age.

Private pension and state support: A strong duo for your retirement

Private pension provision is the backbone of a secure retirement. It fills the gap often left by state and corporate measures. The variety of products offered allows individuals to best meet their pension needs. Traditional pension insurances provide reliable protection through a guaranteed minimum interest rate. They are ideal for security-oriented investors. On the other hand, fund-linked pension insurances offer greater return opportunities through investments in funds but also involve higher risks.

In addition to insurance products, modern banking and investment forms are also an essential part of private pension planning. Stocks and ETFs allow investors to benefit from the growth of global markets, but with associated risks. Savings plans are a popular choice here as they capitalize on the power of compound interest over the years. Real estate, in turn, offers opportunities for value appreciation and rental income. However, they require higher initial investments and strategic planning.

A significant advantage of private pension provision is the ability to take advantage of tax benefits. Products like the Riester pension and the Rürup pension offer various state subsidies. The Riester pension is particularly attractive due to its annual contributions and tax benefits for families, while the Rürup pension offers tax advantages and a reliable pension, especially for the self-employed. These grants can significantly enhance long-term returns.

However, the challenges of demographic change and the pension gap cannot be ignored. With increasing life expectancy and an imbalance between contributors and retirees, the importance of private pension strategies becomes more evident. Comprehensive private pension provision offers the necessary protection and flexibility. It allows investors to choose both one-time payments and regular pension payments. Ultimately, the success of pension planning depends on the strategic choice and combination of suitable products that meet personal needs and financial possibilities. Only then can a sustainable financial future in retirement be ensured.