The prospect of retirement should paint a picture of relaxation and enjoyment, but for many, it is also characterized by financial concerns. The statutory pension alone is often insufficient to maintain one’s usual standard of living. Therefore, private planning is also important. This article explores the three pillars of pension planning and demonstrates how state grants and private pension options can be effectively utilized to ensure a peaceful retirement.

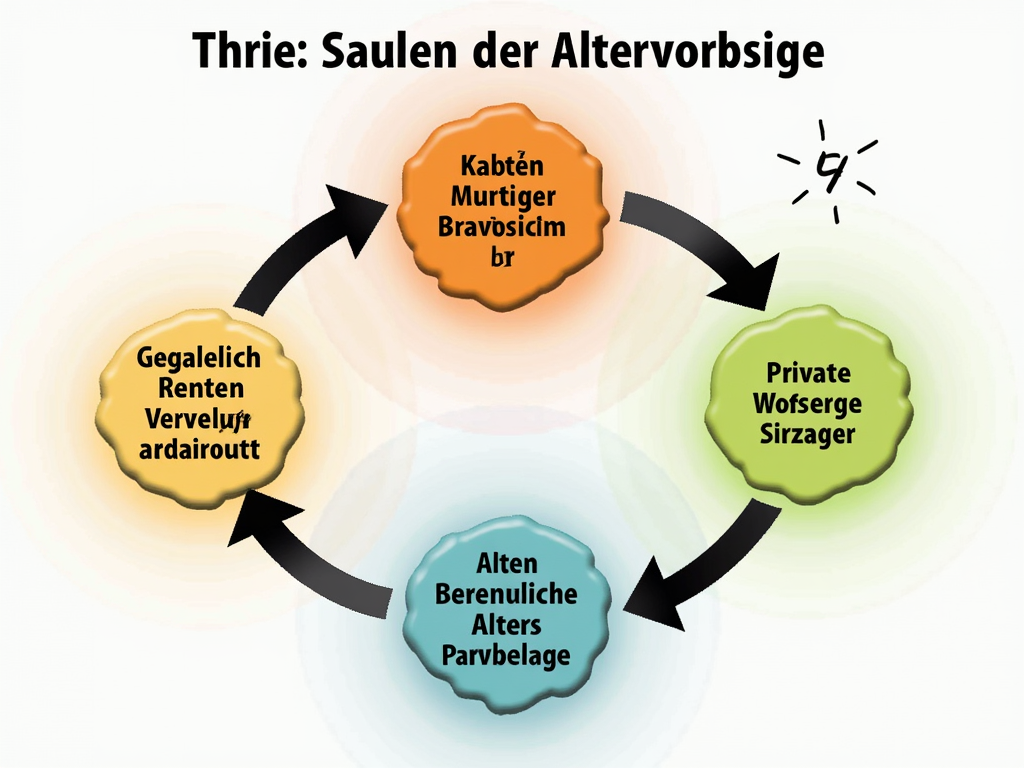

The Foundation of Security: Understanding the Three Pillars of Pension Planning

An economically secure pension essentially starts with a solid understanding of the three pillars of pension planning, which are well established in both Germany and Switzerland. This structure provides a balanced and diversified pension strategy that can be adapted to individual needs.

In Germany, the statutory pension scheme (Pillar 1) forms the foundation of the pension plan. It is based on a pay-as-you-go system, in which the active population finances the pensions for current retirees. However, this alone is often insufficient to maintain the usual standard of living in old age, highlighting the need for additional retirement plans.

The second pillar, occupational pension plans (bAV), represents an added value. It allows workers to generate additional retirement benefits through their employers, often with significant tax advantages. Various implementation methods are available, such as direct insurance and pension funds, which vary depending on the employer.

The third pillar of the pension scheme in Germany encompasses private pension schemes, which enable individual supplementation to the statutory and occupational pensions. It offers a wide range of options, from Riester or Rürup pensions to life insurance and investment models like ETFs. The flexibility of this pillar allows for the development of tailor-made financial strategies, which can lead to tax advantages and potentially higher returns.

The pension planning model of Switzerland is similarly structured, anchored in three pillars. The first pillar, the state pension insurance (AHV), ensures that the basic needs of retirees are covered. The second pillar, the professional pension via pension funds, secures the maintenance of the living standard of employees. Finally, the third pillar, consisting of tax-advantaged savings plans (Pillar 3a) and flexible investment forms (Pillar 3b), completes the individual pension package.

An effective pension plan is based on the correct combination of these pillars. While the statutory and occupational pensions serve as stable foundations, the third pillar offers the necessary margin to meet individual preferences and financial goals. Ultimately, it is essential to start early and make regular adjustments to optimize the pension plan and ensure financial security in retirement.

With State Grants and Private Strategies Towards a Secure Future Pension

When it comes to financial security in retirement, state grants and private pension options offer a compelling dual strategy. In the quest for optimal security in retirement years, these options could not be more important.

The state promotes, among other things, the purchase of a home. Here, the KfW loans stand out, offering favorable interest rates for constructing energy-efficient buildings or renovating existing properties. Also supported are home savings contracts, such as through Wohn-Riester financing, which annually provides up to 175 euros as a subsidy. In addition, numerous regional programs offer further incentives for purchasing residential properties.

In the field of pension provision, the Riester pension plays a significant role. It is particularly suitable for families and offers not only annual subsidies but also attractive contributions for children. Occupational pension plans supported by employers further facilitate protection in old age due to tax advantages, even though they are not directly subsidized by state contributions.

Self-employed individuals or those with high incomes benefit from the Rürup pension, also known as the basic pension. It allows for the tax-deductibility of contributions, making it particularly attractive for the aforementioned groups. The private pension insurance is another pillar that, despite the absence of state subsidies, can boast tax advantages in retirement.

Investment opportunities such as stocks and bonds provide a solid foundation for private pension savings. A balanced mix of ETFs and actively managed funds is advisable, as these minimize risks through diversification and enhance potential returns. For more conservative investors, physical precious metals such as gold can serve as capital preservation instruments.

Let’s not forget the pension funds, which offer interesting opportunities for additional pension savings to certain professional categories, such as lawyers.

State grants and private investments harmonize to bring the dream of a secure pension closer. It is advisable to remain flexible in pension planning and regularly review individual strategies to maximize the benefits from all available options.