In the complex world of financial investments, ETFs play a unique role when it comes to taxes. For investors and private savers in Germany, understanding the tax mechanisms associated with ETFs is crucial. From the advance tax to capital gains: this article highlights the main aspects of taxation on ETFs. Thus, you can optimize your tax strategy and avoid unnecessary burdens. The following chapters provide more detailed insights into the tax treatment of ETFs and help you successfully manage your tax return.

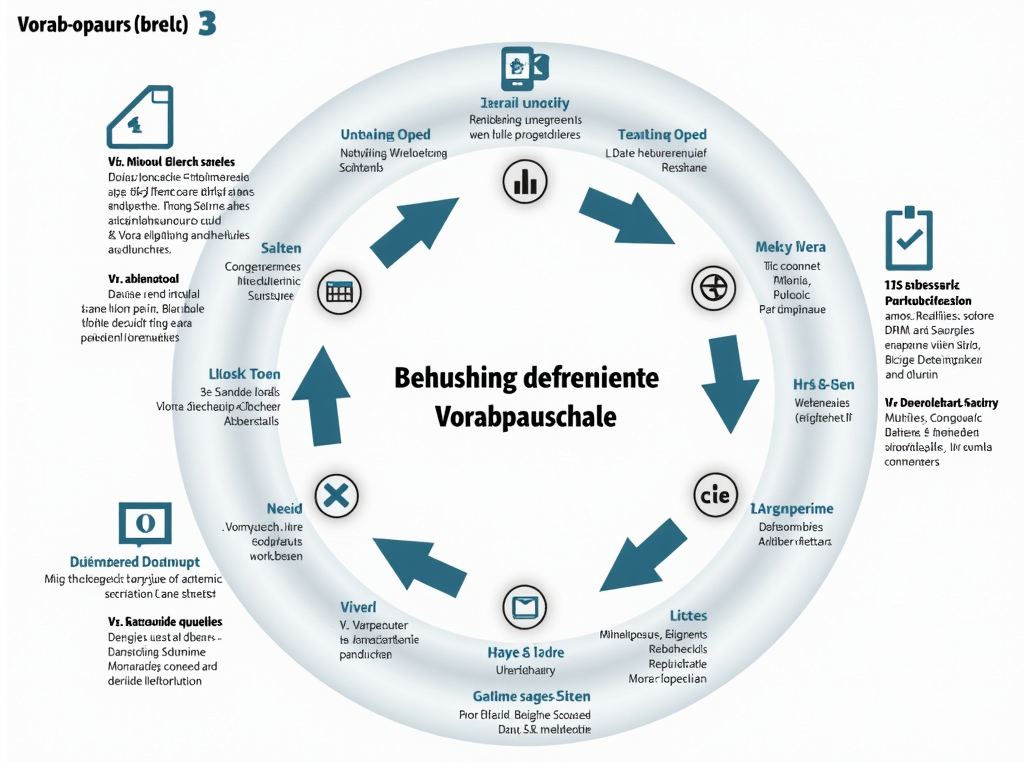

Advance Tax: A Central Aspect in ETF Tax Planning

The taxation of ETFs in Germany may seem complex at first glance, particularly when it comes to accumulation funds and the so-called advance tax. This concept, a fundamental part of the ETF tax regime, requires some understanding to fully leverage its tax advantages.

The advance tax is applied to the increase in value of a fund and is based on an annual base interest rate set by the Federal Ministry of Finance. Notably, this tax is based not on realized profits, but on fictitious profits. This means that even if no funds are withdrawn from the fund, the tax is due. This regulation particularly affects investors in accumulation ETFs, where profits are not distributed but reinvested.

The calculation of the advance tax occurs by multiplying the fund value on January 1st by the current base rate and a fixed factor of 0.7. A representative example: with a fund value of 10,000 euros and an interest rate of 2.29% in 2024, the advance tax would amount to 160.30 euros. This is a strategically relevant fictitious income calculation, as it serves as the basis for the imposition of the capital gains tax, which is set at 25%, supplemented by a solidarity surcharge and, if applicable, church tax.

It is important for investors to consider the advance tax not as an isolated entity, but as part of their overall tax strategy. Here, the order of exemption plays a significant role, allowing capital income up to 1,000 euros per person to remain exempt from tax. If the advance tax falls within this limit, no tax is due, resulting in a reduction of the tax burden.

Finally, it is essential to consider the advance tax within the context of long-term investment planning. It offers the opportunity to proactively plan tax advantages and can be utilized in an optimized tax strategy through offsetting with subsequently realized profits. This increases the efficiency of the investment policy and provides a strategic direction for investors thinking long-term.

Gains from ETF Sales: Tax Pitfalls and Reporting Obligations

The tax treatment of gains from ETF sales is a central part of investment management in Germany. Anyone planning to sell an ETF must know exactly the related tax obligations to avoid unpleasant surprises. Gains from sales occur when the selling price of the ETFs exceeds the initial acquisition costs. In Germany, these gains are subject to the investment income tax.

The investment income tax of 25% is applied to the profit from the sale, along with a solidarity surcharge of 5.5% and, where applicable, church tax. A significant advantage of this system is that taxes are withheld at the source, which greatly reduces the administrative burden for private investors. Generally, no further declarations are necessary in the tax return unless exceptions arise.

To correctly declare gains from sales, it is important to receive all necessary documentation from your deposit service provider. This includes the tax certificate, which documents the withheld taxes. In the KAP attachment to the tax return, this information can be verified and corrected if necessary. The so-called suitability check should not be underestimated. If your personal income tax rate is below 25%, you can request, by submitting the KAP attachment, to apply a more favorable tax on your income. This could lead to a refund of some of the taxes already paid.

For investors who have a peak of tax-exempt gains, it may be beneficial to use the annual exemption order. This order allows your deposit service provider not to apply taxes on capital income up to a certain amount (currently 1,000 euros per person).

Finally, it may be worthwhile for investors to consult a tax advisor to gain a deeper understanding of the tax implications and optimize them individually. Proper tax planning can significantly increase the net return on your investments and ensure transparency in accounting. A comprehensive knowledge of the tax conditions and the taxes anticipated on gains from sales is essential for sustainable and successful investing.