Cryptocurrencies have taken over the finance world, offering the promise of high returns and technological innovation. However, these opportunities are also associated with significant risks. This article explores the underlying technology and the volatile markets of Bitcoin and Ethereum, providing valuable advice for newcomers to navigate this dynamic environment. The following chapters offer an insight into blockchain technology as well as the opportunities and risks of these digital currencies.

Blockchain and Mining: The Technological Pillars of the Crypto Revolution

Cryptocurrencies fascinate due to their volatility and potential high returns, but also because of the impressive technology that supports them. At the heart of this digital revolution are two key technologies: Blockchain and Mining. Together, they create a decentralized infrastructure that allows for trust and transparency in digital transactions, without the need for a central intermediary.

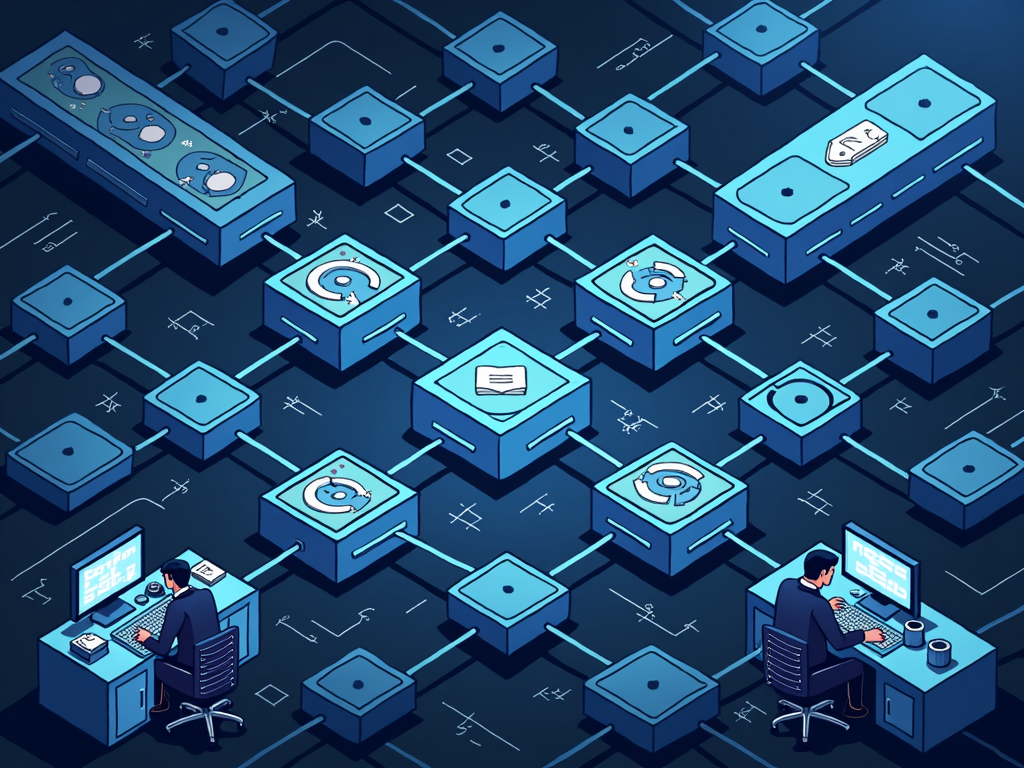

The Blockchain is the cornerstone of every cryptocurrency. It functions as a public and decentralized database, organized in a chain of interconnected blocks. Each block contains a list of transactions that are secure and linked together through cryptographic procedures. This structure ensures that once information has been recorded in the blockchain, it cannot be altered. A central element of this technology is the cryptographic hash function, which gives each block a unique fingerprint and links it to the previous block. This chaining ensures the integrity of the blockchain and prevents manipulation.

Another fundamental concept in blockchain technology is the consensus mechanism. Since the blockchain is stored distributed across a network of computers, known as nodes, all participants in a network must agree on the current state of the blockchain. The most well-known method for achieving this consensus is Proof of Work (PoW), where miners, or network participants, solve complex mathematical puzzles to add new blocks to the blockchain. This Mining process not only represents a significant energy burden, but is also a core element in ensuring the integrity of the network.

However, mining also has its pitfalls: it is resource-intensive and causes a significant environmental impact. In response, some cryptocurrencies have introduced alternative consensus mechanisms, such as Proof of Stake (PoS). In this approach, the confirmation of transactions is guaranteed by participants who deposit a certain amount of their coins as collateral. This significantly reduces energy consumption and also allows for higher transaction speeds.

The combination of blockchain and mining technologies offers an innovative foundation for cryptocurrencies, extending far beyond mere financial transactions. With the ability to enable Smart Contracts, various applications can be automated when predetermined conditions are met. This technological foundation could have a disruptive impact on numerous sectors in the future, allowing for new business models and services that do not require central entities.

Opportunities and Risks: The Dual Faces of Cryptocurrencies

Cryptocurrencies have now become an integral part of the global financial system and generate great interest among both speculative investors and technological innovators. The discussion of their opportunities and risks is crucial to informing potential investors as well as regulators about the multiple perspectives of these digital markets.

Opportunities in the Digital Financial World

One of the most significant advantages of cryptocurrencies is their capacity for institutionalization and increased acceptance. Large financial institutions are showing growing interest in cryptocurrencies, leading to an expectation of greater stability and market size. Moreover, technological innovations such as decentralized finance (DeFi) are driving the development of financial services without central authorities, promoting a more autonomous economic system.

Regulatory evolutions also play a key role in developing the opportunities for cryptocurrencies. The introduction of clear and transparent regulations can strengthen investor trust, making markets more stable and secure. In a context with clear guidelines, cryptocurrencies can not only thrive but also become an essential part of diversified investment portfolios.

Long-term investment opportunities exist primarily for established cryptocurrencies such as Ethereum and Bitcoin, which are considered relatively stable investments. However, new projects like Solana or Cardano also offer interesting prospects thanks to innovative technologies and concepts that push forward the continuous evolution of the market.

Risks of the Volatile Crypto Market

Conversely, there are risks associated with cryptocurrencies. Their volatility, in particular, is known for significant price fluctuations, which are both risky and unpredictable. This instability is further exacerbated by regulatory uncertainties, as potential harsh regulations or bans in certain countries could hinder growth.

Technological and security risks cannot be overlooked. Cyber attacks and reliance on stable technical infrastructures present significant challenges. Financial instability could also arise if dynamic developments in the crypto sector challenge existing financial models.

In conclusion, cryptocurrencies offer fascinating opportunities but are accompanied by significant risks. Thorough market research and a well-planned diversification strategy are essential for success in the crypto market. Investors must be aware of the volatility and uncertainties while harnessing the innovative power of technology.