The online brokerage market resembles a dynamic chess game, where the right choice of broker can determine wins or losses. Investors and individuals face the challenge of finding the most economical way to trade securities. A deep dive into fee structures, trading offers, and services is key to finding the broker that perfectly fits individual needs. In the following chapters, we will shed light on the decisive factors to consider when choosing the best online broker.

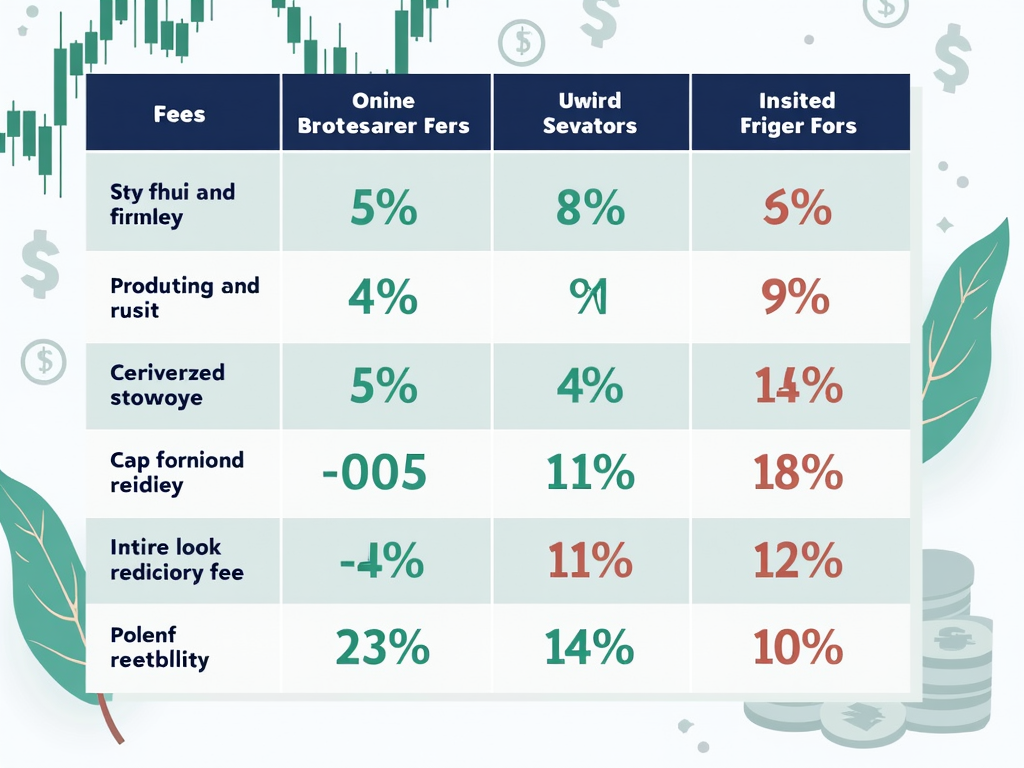

Fees in Detail: Discovering the Ideal Broker for Cost-Effective Trading

Choosing the right online broker can turn out to be costly if the fee structures of various providers are not thoroughly compared. In the world of securities trading, it is essential to minimize fees to maximize returns. Let’s take a closer look at some of the most favorable fee options.

First, Finanzen.net Zero is one of the most attractive alternatives for investors wanting zero commissions per order. With a reduced spread as the sole cost factor, investors can operate optimally, as long as they avoid written orders that cost €25.

Another leading candidate is Trade Republic, which charges only €1 per order and offers commission-free ETF savings plans. This structure encourages frequent trading and makes Trade Republic particularly attractive for ETF-focused investors.

Scalable Capital, especially the Free Broker, provides a cost-effective way to operate across various markets. At €0.99 per order on Gettex and low-interest balances up to €50,000, this broker demonstrates its appeal to investors with limited capital as well.

Those looking for a variable trading market should consider Smartbroker+. Operating entirely without deposit fees, Smartbroker+ offers free trading starting from a volume of €500 and a low exchange fee below that threshold. Notably, commission-free ETF savings plans make Smartbroker+ stand out in this regard.

Flatex allows reduced commissions due to its promotions for new customers, but at €5.90 per order, up to €40,000, it is the most expensive in this group. However, even here, frequent traders find incentives through regularly offered promotions.

Finally, eToro offers a unique structure for investors with a global perspective. While the inactivity fee may be seen as a potential trap, the costs for orders up to $2 are well thought out and highly attractive, especially for ETF investments.

This detailed overview clarifies: there is no perfect broker, but rather the perfect choice depending on individual trading behavior. A comparison based on the fee structure is key to finding an ideal long-term partner for cost-effective trading.

Variety and Services in Focus: Finding the Best Online Broker for You

The comparison of online brokers is now a top priority for investors seeking the most economical and efficient way to trade securities. In this context, the commercial offerings and services play a crucial role, differentiating limited services from extraordinary ones.

Trading Offer

A comprehensive trading offer is an essential aspect when choosing a broker. Finanzen.net Zero, for example, stands out for its commission-free trading conditions and absence of deposit fees, offering trading with over 6,000 stocks and 2,000 ETFs – ideal for beginners and enthusiasts of savings plans. Moreover, cost-conscious traders appreciate the minimum order fee of €1 at Trade Republic, where they can choose from an admirable variety of over 8,000 stocks and 50 cryptocurrencies.

For those seeking generous financial instruments, Smartbroker+ provides access to more than 40,000 stocks across various international markets and allows commission-free transactions when a minimum amount of €500 is reached. DEGIRO, on the other hand, does not offer savings plans but is known for its low order fees and access to international exchanges, making it a popular choice among experienced traders.

Services

In addition to the trading offer, services are fundamental to ensuring an overall positive trading experience. Mobile apps allow for convenient trading on the go, with Trade Republic standing out with a user-friendly app featuring a quick account opening and an intuitive interface. The Finanzen.net Zero platform is also modernly designed and supports traders with a clear focus on usability.

Exceptional customer support can become a decisive factor in comparing brokers. Smartbroker+ offers comprehensive support not only via phone but also by email, thus taking the service to a personal level. Trade Republic ensures quick resolution through fast chat support for urgent inquiries from investors.

Ultimately, the choice of the right broker depends on individual needs. A high level of security standards, such as that offered by DEGIRO with its deposit protection, enhances the broker’s reliability and appeal. Each individual offer has its advantages, but an individualized comparison leads to the suitable provider for specific trading needs.