In a world where financial freedom and flexibility are increasingly valued, peer-to-peer (P2P) lending offers a breath of fresh air for investors. These platforms allow investors to lend directly to those in need of a loan, earning attractive interest rates. But how do these platforms actually work, and what opportunities and risks do they entail? This article explores the underlying mechanisms of P2P lending and provides a clear view of the advantages and disadvantages for investors.

P2P Lending Platforms: A New Dimension in Capital Intermediation

P2P lending platforms represent a revolutionary step in the financial world, directly connecting investors with loan applicants, without the need for banks as intermediaries. These online platforms open up fascinating possibilities for both investors and loan applicants, radically changing the lending landscape.

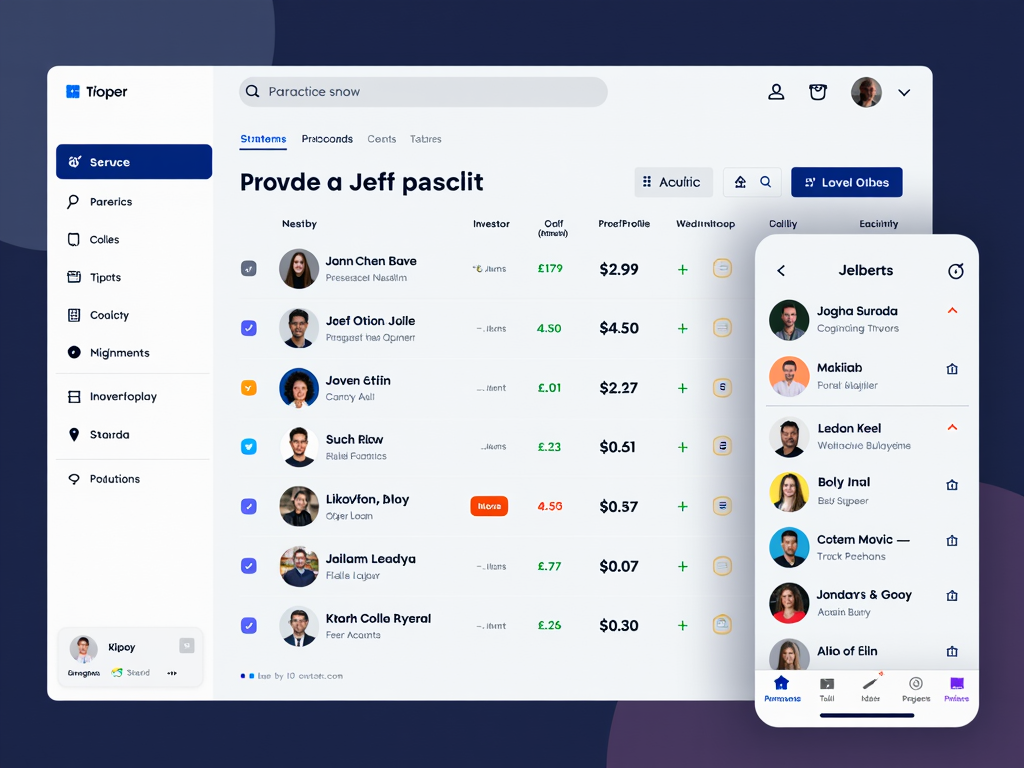

The heart of the operation of P2P lending platforms lies in their role as intermediaries. They create a digital market where loan applicants can present their projects or funding needs, and investors can specifically choose which loans or projects they wish to invest in. The platform handles a substantial part of the risk assessment, performing extensive credit checks on loan applicants. This ensures that investors can make informed decisions, while applicants have the opportunity to secure their funding.

In terms of payment management, the platform is available to ensure that repayments are made punctually and completely. Investors receive interest on the invested capital, often exceeding those offered by traditional investments. These attractive returns represent one of the main incentives for why many investors opt for P2P lending.

Another advantage is the easy accessibility of these platforms. Unlike the complex registration processes and high minimum thresholds of traditional investment forms, P2P platforms stand out for their simple registration and low minimum investments, often starting from 10 euros per loan. This allows for wide participation even for small investors, who might otherwise be excluded from lucrative opportunities.

However, it is also important to pay attention to the risks. The risk of default, meaning the possibility that an applicant does not fulfill their obligations, poses a real danger. Additionally, there is no deposit protection in case of default, which requires careful risk management by investors. This is compounded by regulatory uncertainty, as different platforms operate in various countries, often with different policies and protection mechanisms.

In choosing the appropriate platform, investors should pay attention to whether it is regulated and if it offers buyback guarantees, which can reduce the risk of insolvency. Portfolio diversification, meaning spreading invested capital across various loan projects, is also a crucial step to distribute risks and enhance the chances of stable returns. P2P platforms offer considerable transparency, providing detailed information about applicants and their projects, which supports informed investment decisions.

Investing in P2P Loans: Potential and Caution

P2P lending offers an intriguing investment opportunity, promising high returns and diversification benefits. For investors looking to grow their money outside of traditional pathways, this form of investment represents an attractive alternative. However, before diving into the world of P2P lending, it is crucial to carefully consider both the opportunities and the risks.

One main incentive for investors is the potential high returns that P2P loans offer compared to classic bank investments. Platforms like PeerBerry promise annual returns of up to 11.5%, while others, like HeavyFinance, can even reach 14%. This level of return generally exceeds the interest rates offered by traditional banking products. However, it is always necessary to be aware that higher returns also entail greater risks.

Moreover, investing in P2P loans allows for a widely diversified portfolio. Investors can spread their capital across different types of loans and geographical regions, thus helping to minimize risks. This diversification helps reduce the impact of a single loan default on the entire portfolio.

Another advantage many platforms offer is a certain level of liquidity. Since many P2P loans are short-term, investors can access their invested capital more quickly compared to other forms of investment. This is particularly beneficial in a volatile market context.

However, as alluring as the stated advantages may seem, investors in P2P loans must also face significant risks. The risk of default is one of the most severe: if an applicant defaults, invested amounts could be at risk. Furthermore, in most platforms, there is no deposit protection, as is common in traditional banks, which increases the risk of financial loss in the event of platform insolvency.

Additionally, many P2P platforms operate in legal gray areas, as some are not under the supervision of financial authorities. Therefore, investors should pay particular attention to the specific regulatory context and carefully assess which provider to collaborate with.

A strategic approach for risk mitigation in the P2P sector involves the targeted use of buyback guarantees, which many platforms offer. These guarantees obligate platforms to buy back defaulted loans after a certain period, significantly reducing the risk for investors.

Overall, investing in P2P loans offers the potential to generate attractive returns and diversify one’s portfolio, but it requires careful risk assessment and vigilance in choosing the platforms.