Securities trading has rapidly evolved in recent years thanks to digitalization. Online brokers offer investors a convenient and cost-effective way to participate in the market. But which broker best suits your needs? We compare the fee structures, trading offerings, and services of the leading providers to make it easier for you to choose the right broker. In the following chapters, you’ll discover what to consider when choosing and how to find the best broker for your investment strategy.

Hidden Fees: The Smart Way to Save in Brokerage

Understanding Fee Structures – The Key to Saving

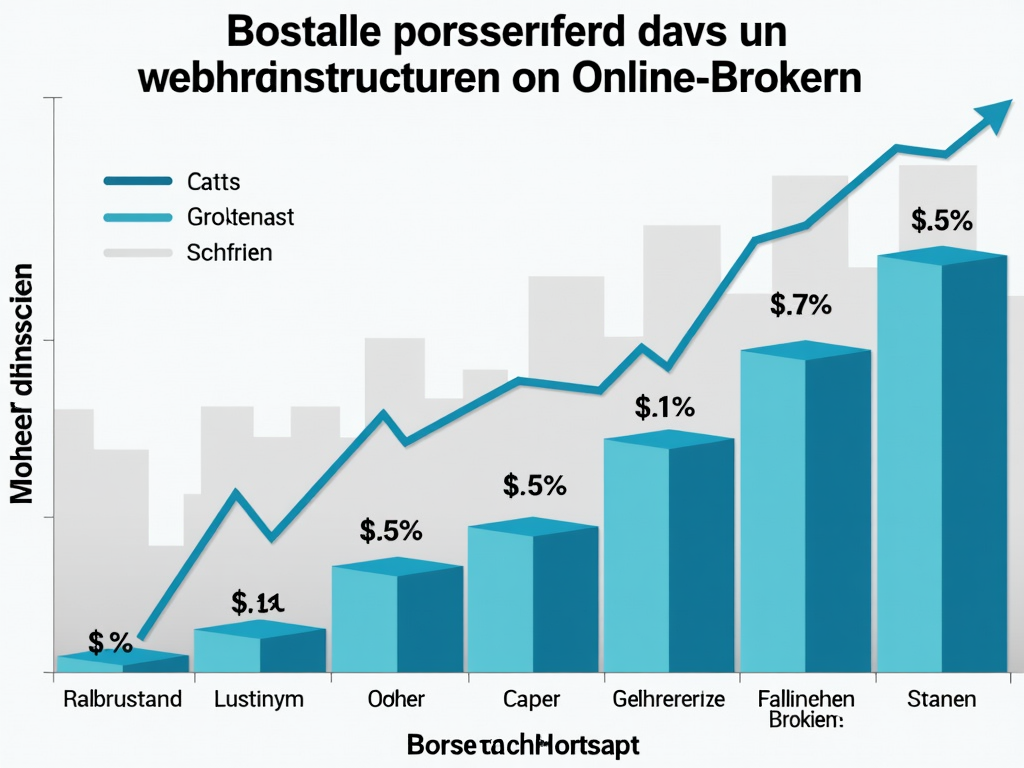

When trading securities through online brokers, the right fee structure can be crucial for saving money in the long run or, conversely, for spending more than planned. The fees that brokers charge vary significantly, and being aware of these differences helps you make informed decisions and better pursue your financial goals.

Fees are an invisible yet omnipresent component of every transaction. They appear in various forms: transaction costs, spreads, and even account management fees. In the case of cryptocurrencies, fees are often hidden in the spreads – the difference between buying price and selling price. A low spread is essential to ensure that your investment is not eroded by disproportionate fees.

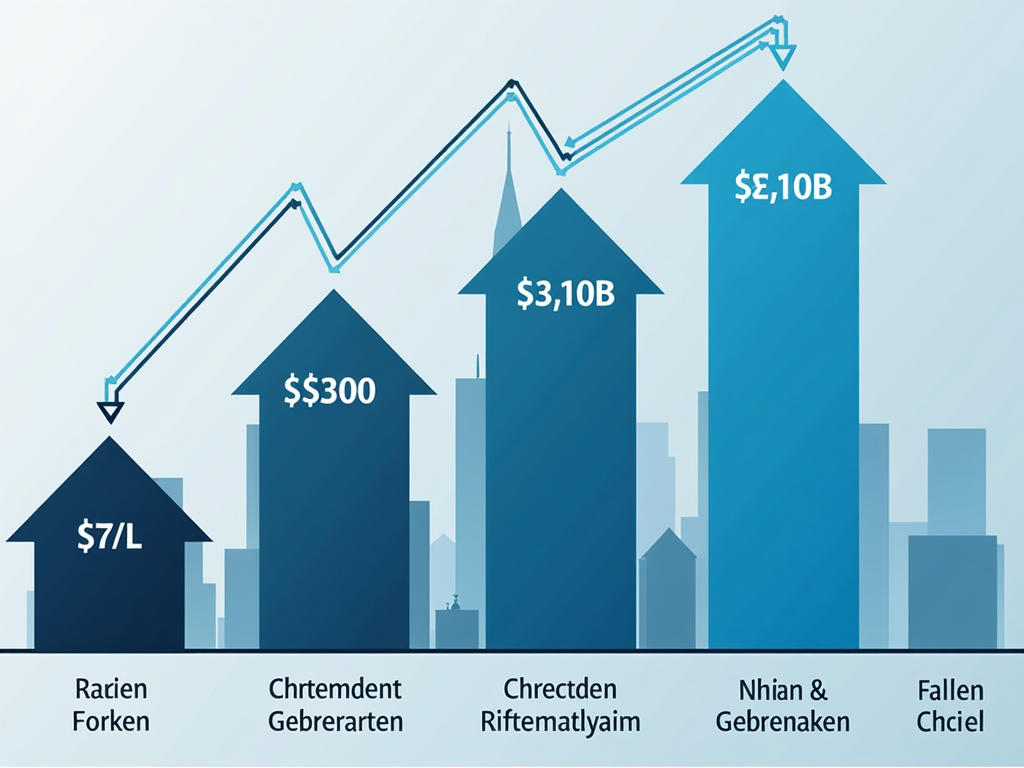

For stock traders, order costs are a relevant factor. These fees can be fixed or calculated as a percentage of the traded volume. While a fixed amount can be advantageous for large investments, smaller investments tend to benefit from a percentage-based approach. Therefore, it is crucial to align your trading structure with these fees.

Credit cards provide another example. Here, fees can vary significantly. In addition to annual fees, interest on exceeded credit limits and cash withdrawal costs must also be considered. However, reward programs and additional services such as insurance can justify the price if chosen and used carefully.

Strategies for Reducing Fees

To effectively reduce fees, it is advisable to implement a combination of acquiring knowledge and conscious planning. Choose brokers with transparent fee structures and utilize demo accounts to understand their models without risks. In the long term, through strategic planning, such as investing in larger tranches, and leveraging tax benefits, you can maximize your returns. Remember that less obvious fees, such as management fees for funds, can also have an impact and should be considered in your calculations.

This clarity and strategy will enable you to manage your investments effectively and efficiently address your financial planning. By understanding and minimizing hidden costs, you can utilize your capital more effectively and get the most out of every euro invested.

Variety of Trading and Quality of Service: The Cornerstones of Successful Online Brokers

In the dynamic world of online securities trading, trading offerings and services play a central role in choosing the appropriate broker. A diverse trading offering and exceptional support services can make the difference in an investor’s success.

Online brokers provide access to an impressive range of financial instruments. Many of these platforms allow trading in CFDs, stocks, ETFs, forex, and cryptocurrencies. This variety offers investors the opportunity to effectively diversify their portfolios and reduce risks. Platforms such as Trade Republic and Scalable Capital stand out for their wide offering of stocks and ETFs, while eToro also allows trading in commodities and currencies.

The service provided by a broker is just as important as the trading offering. Comprehensive customer support services and user-friendly platforms are essential for ensuring a smooth trading environment. Platforms like comdirect offer their customers 24/7 support, which is particularly reassuring during stressful market periods. Additionally, educational offerings are an important aspect, especially for beginners. Many brokers, including AGORA direct, provide extensive educational resources to facilitate entry into trading and deepen knowledge.

Another crucial aspect is the security of the trading platform. Regulations from supervisory authorities and solid deposit protection offer investors an additional safeguard. An example of this is comdirect, which adopts advanced security measures to protect customer data integrity.

In summary, a combination of a broad trading offering and excellent services represents the foundation of success in digital securities trading. Choosing the right broker depends not only on fees but also on the variety of trading opportunities and the quality of support services. Together, these factors create added value that benefits both beginners and experienced traders.