The world of online brokers is a dense jungle of paths, where the ways to low-cost value trading intertwine. To find the best route, a clear compass is necessary. Commissions, trading offers, and services are the decisive factors that indicate the way. This article illustrates how these elements can be harmonized to find the ideal broker for your individual needs.

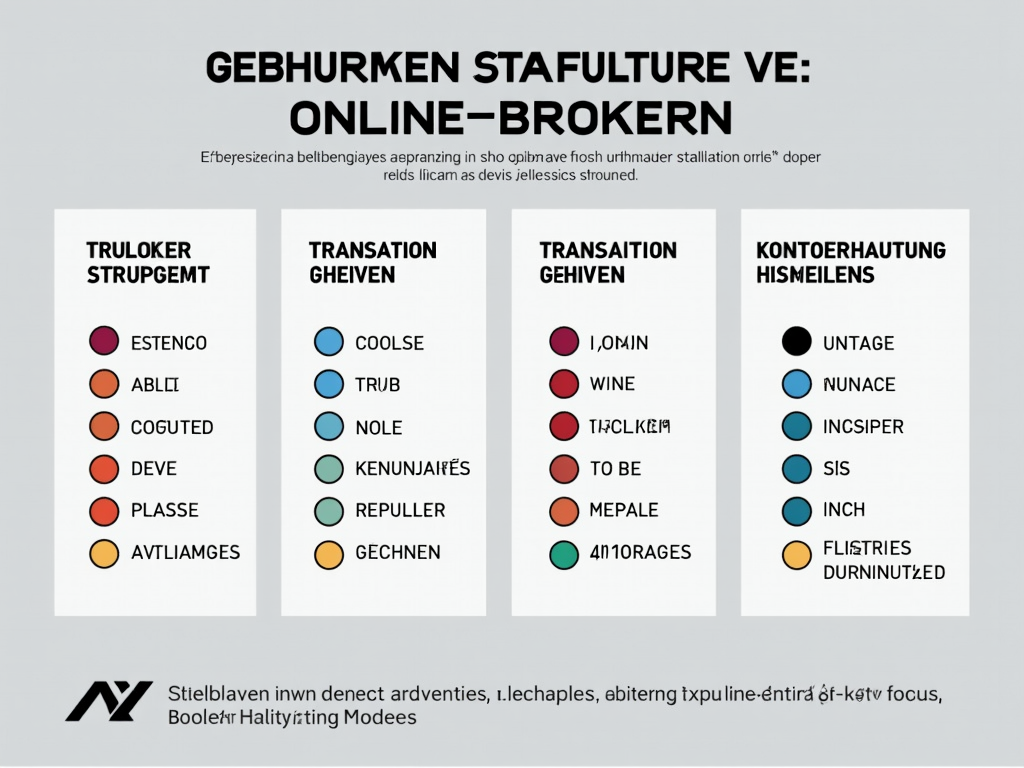

Commission Structure: The Key to Your Success in the Stock Market

The choice of the right online broker often begins with a careful look at the commission structure. While some providers attract with low or even zero transaction fees, the real cost structure can be complex.

Flatex stands out with its fixed order commissions. Existing customers pay €5.90 per order, while new customers can start paying only €1.90 in the first twelve months for selected markets. However, variable exchange fees depending on the chosen market can incur additional costs that can vary considerably. This makes Flatex attractive for investors who trade regularly on low-cost exchanges like Tradegate.

S Broker offers a combination of fixed and variable costs through an order fee of €4.99 plus 0.25% of the order value. Market costs vary and there is also a fixed fee for telephone orders. However, frequent traders could benefit from the discounts offered, making S Broker appealing for active traders.

1822direct combines a fixed order fee with a percentage of the order volume, which might make larger transactions more expensive, but a selection of free savings plans could be attractive for long-term investors. Similar structures are present in Comdirect, which applies a percentage fee for orders and offers similar conditions for savings plans.

ING Depot and Trade Republic also offer fixed commission models. While Trade Republic stands out for its low additional costs of only one euro per order, ING Depot operates with a combination of fixed costs and percentage fees, which could affect some strategies.

A particular advantage of Smartbroker is the ability to execute free transactions starting from a certain volume at selected exchanges, making it attractive for larger investments or specific markets. However, Xetra orders are subject to additional costs.

In comparing these structures, it is clear that individual trading preferences and volumes are crucial for choosing the right broker. Frequent traders might benefit from discounts or volume-based models, while occasional investors may prefer a low fixed cost structure. Integrating commissions with one’s trading strategies is therefore a decisive factor for the success of long-term investments.

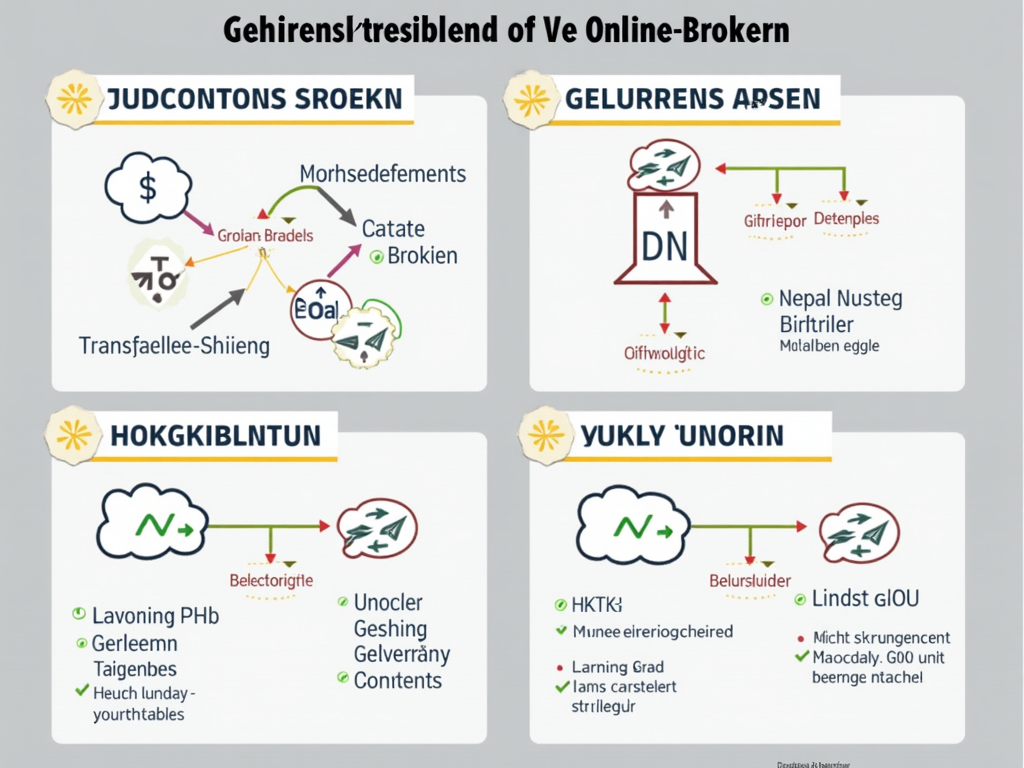

Discover the Variety: Optimal Trading Offer and Services

The modern financial market offers investors and traders an impressive variety of trading opportunities. A comprehensive trading offer, combined with high-quality services, represents a unique opportunity to achieve financial goals. In this context, online brokers play a central role. They not only provide access to a wide range of financial instruments but also tailored services to support their trading success.

Online brokers like eToro, Smartbroker+, and Trade Republic stand out for their wide range of tradable assets. Whether stocks, ETFs, cryptocurrencies, or commodities, with just one deposit you can diversify your portfolio. This diversification is not only strategically advantageous but is also an essential element of solid investment management. Platforms like AGORA direct also provide the opportunity to invest in various asset classes like CFDs and Forex, ensuring further strategic flexibility.

In addition to the trading offer, services are crucial for a satisfying user experience. A user-friendly platform like that of eToro is an excellent example of how important usability is for success in online trading. Additionally, many brokers offer extensive educational materials. This particularly allows beginners to acquire the necessary knowledge to enter the market with greater confidence. Platforms like the comdirect Akademie are known for their detailed educational offerings, making it as simple as possible to learn the mechanisms of the market.

Another important feature is customer support. Customer-oriented brokers like Fidelity Investments offer active service 24/7. This ensures that technical issues or urgent questions can be resolved quickly, thereby creating trust and making trading a smooth experience.

Last but not least, security is a central aspect. Regulation by reputable oversight authorities like BaFin, as in the case of AGORA direct, provides investors with the necessary protection to invest with confidence. Membership in deposit guarantee schemes is also an important security aspect that investors should not underestimate.

In summary, online brokers offer an impressive combination of trading variety and supportive services. These not only enhance the efficiency of the trading process but also foster user confidence and satisfaction. By choosing a broker that meets your specific needs and preferences, you can take a decisive step towards successful investment strategies.